Project Overview

- Participated in a practical UX internship at Firma, a design agency as part of my B.A. studies.

- As a UX Designer ,I was responsible for redesigning a digital loan process for a bank in Israel Using Firma’s UX team's methods & processes

- The project's primary objective was to collaboratively establish a 'Double Diamond' method.

Tal Solomon

Head of the UX program @ MTA

“A project with a lot of investment. The process itself is high quality & efficient. I appreciate the experience and effort, a very successful prototype came out, well done!”

Discovery

Competitor Research

The initial step involved seeking out existing knowledge related to digital loans.

The research approach began with exploratory research, starting with competitor analysis, followed by a deep dive into user research. This approach allowed to gain a holistic understanding of the digital loan landscape prior to engaging with platform users.

The instructions for this phase:

- Constructing research questions:

- What are the most common platforms for taking a digital loan?

- How many and what are the steps in the digital loan procedure at the various banks?

- Mapping of direct and indirect competitors.

- Collecting materials and sorting them according to the research questions.

- Extracting insights from the collected information and presenting them.

Insights

Clarity and Certainty

Initial screen with a clear process overview, user progress indication, and a detailed step summary.

Streamlined Steps

Digital loan processes should save time while maintaining balance: not too short (suspicious) or overly lengthy (tedious).

Building Trust

Clear guidance through tooltips, toggles, and concise yet detailed copy.

User research

Our user interview preparation process encompassed the following stages:

- Development of targeted, research-objective-aligned questions

- Rigorous selection of relevant participants

- Execution of semi-structured interviews

- Analysis and extraction of key insights from collected data

Employing a qualitative research methodology, we focused on gaining an in-depth understanding of loan processes and user behaviors across both digital and traditional channels.

Define

Main User Research Insights

Balanced Loan Approach

Users seek loans for both emergencies and planned expenses, indicating a need for versatile loan products.

Digital Convenience Priority

The appeal of instant digital loans stems from their speed and ease of use, highlighting the importance of streamlined processes.

Bank Loyalty Prevails

Despite digital options, users prefer loans from their primary banks, emphasizing the value of established financial relationships.

Persona

User Flow

Under each flow, I added a note whose purpose is to explain the flow: its location and the rationale behind it.

Design & Deliver

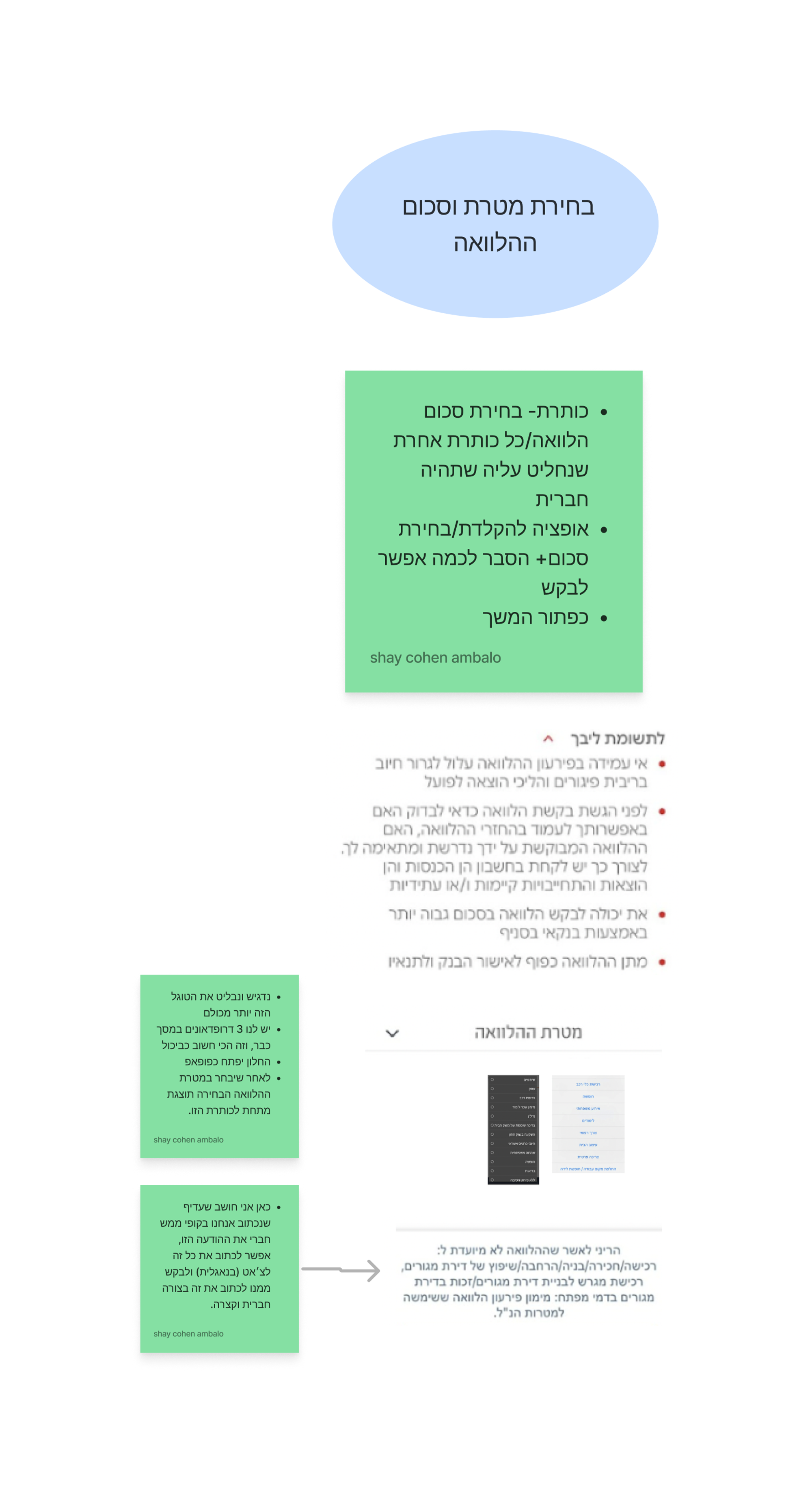

Screens Re-Design

The planning and execution of screen creation were facilitated through a systematic segmentation process. Each decision point, choice, and screen from the User Flow was individually analyzed. For every stage or screen, detailed specifications were developed, outlining the specific elements and content to be featured.

Below these elements, competitor screen examples were incorporated, complete with visual references. These examples serve dual purposes:

- Providing inspiration for the design process

- Serving as practical references to apply insights gathered from comprehensive competitor and user research

Wire-framing

To The Prototype

High-Fidelity Screens

Challenges

1. Terminology: Initially, the unfamiliar terminology and financial concepts in the world of loans posed a hurdle, making it challenging to immerse ourselves in this domain.

2. Competitor Research: While conducting competitor research on various platforms, we couldn't complete the process by actually taking a 'real' loan. As a result, we lacked insight into the final stages of obtaining a digital loan from different competitors.

3. User Research: User research in the context of loans presented its own set of difficulties. The topic was sensitive and personal, leading some participants to withhold certain details during interviews. This hesitancy may have prevented us from fully understanding their genuine pain points. Additionally, conducting remote interviews via Zoom posed a potential obstacle to building trust on such a personal and sensitive subject.